The Foreign Exchange Management (Export and Import of Goods and Services) Regulations, 2026, trade regulations consolidate export and import rules and promise faster, digital compliance. However, behind this reform lies a deeper shift: regulatory power has moved from the RBI to commercial banks. This explainer shows what changed, why it matters, and who bears the risk.

India's foreign exchange regulation has entered a quiet but important transition. With the notification of the Foreign Exchange Management (Export and Import of Goods and Services) Regulations, 2026, the Reserve Bank of India has not only merged export and import rules, but has also changed who controls key compliance decisions. The full text of the Regulations was issued through RBI's official notification dated January 13, 2026

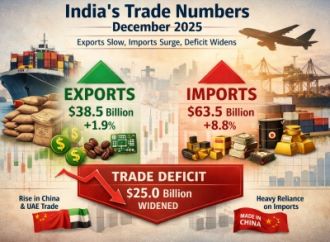

At the same time, this regulatory change comes when India's external trade has grown larger and more complex. In particular, services exports now play a critical role in balancing fluctuations in goods trade and global demand cycles, as explained in ABC Live's analysis of India's trade performance in 2025. Therefore, the regulatory framework governing foreign exchange has a greater economic impact than before.

From RBI-Led Control to Bank-Led Decisions

For many years, FEMA compliance followed a centralized RBI-led model. Under this system, RBI circulars guided exporters and importers across the country. Although the process involved heavy paperwork, outcomes were largely predictable and uniform.