Natural rubber (NR) futures showed a mixed trend in the third trading week of May, following two weeks of moderate gains.

The week ended 23 May saw a decline in trading volumes across all major Far East exchanges, as traders adopted a "cautious stance", according to a 26 May report by Japan Exchange Group (JPX).

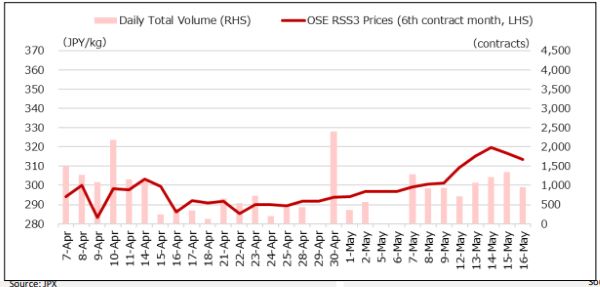

In Japan, OSE October delivery rubber contracts closed 2.1% higher week-on-week in quiet trading. Weekly volume and open interest fell, indicating "light short covering", JPX noted.

In Shanghai, China, SHFE and INE rubber contracts ended the week down 2.0% and 0.2%, respectively.

In Singapore, the SICOM August 2025 rubber contract closed 1.0% lower amid "quiet, range bound trading."

In rubber related news, China’s largest tire maker, Zhongce (ZC) Rubber, was listed on the Shanghai Stock Exchange on 23 May, raising €600 million for five expansion and renovation projects.

Meanwhile in Malaysia, the state of Sabah is working to revive its rubber industry as part of a modernization initiative by the country's rubber small holders authority.

The plan involves "establishing high tech depots, introducing advanced tapping techniques, and promoting value added production".